December Mortgage Rates

Thanks to Mark Hines of Fidelity Bank for this episode of Tips from the Pros about mortgages.

The Fed

As it now stands, the Fed has penciled in three 25 basis-point hikes in 2019. However, the chances of those projected rate hikes actually seeing the light of day are declining rapidly. While the Fed is expected to bump their short-term benchmark rates 25 basis points higher next week Wednesday — the futures markets are showing investors are now assigning 50-50 odds to the likelihood the Fed will raise rates even once in 2019.

Believe it or not, the end of the tightening moves by the Fed is not particularly good news for the prospects of steady to lower mortgage interest rates. When the Fed is raising their benchmark short-term interest rates, the process tends to reduce the demand for capital which ultimately pushes long-term rates lower. If the process ends, demand for capital begins to expand which in turn pushes up long-term rates.

Uncle Sam doesn’t worry about interest rates because he has the exclusive authority to print money or to tax to generate the capital to pay his debt. The rest of us must compete against Uncle Sam’s advantage to generate the financing resources to drive our mortgage operations. Massive amounts of new supply washing into a market already struggling to absorb the volumes that exists today is not by any stretch of the imagination the formula for steady to perhaps fractionally lower mortgage interest rates ahead.

As they do every Wednesday, the Mortgage Bankers of America have released their Mortgage Application Survey for the week ended December 7th. Overall single-family mortgage demand finished the reporting period 1.6% higher. Refinance demand was up 1.8% and purchase money loan requests climbed 2.5% higher.

Next year

Also please remember that the middle of January the FHLB Grant will again be available. $7,500 for 1st responders, teachers and medical folks. $5,000 for everyone else.

Feel free to reach out if you need any help.

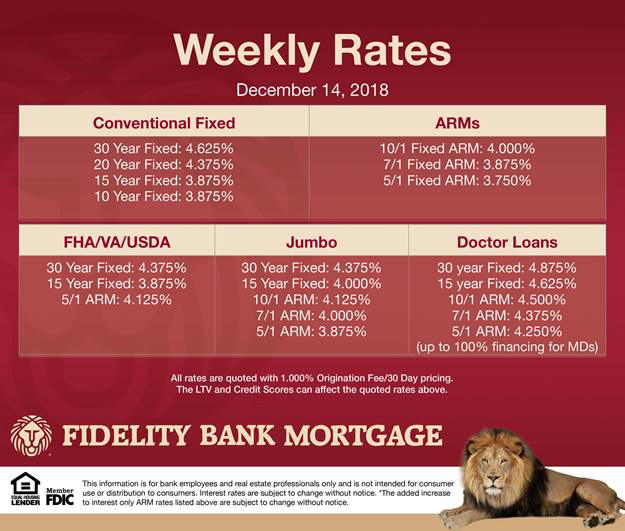

1 Point

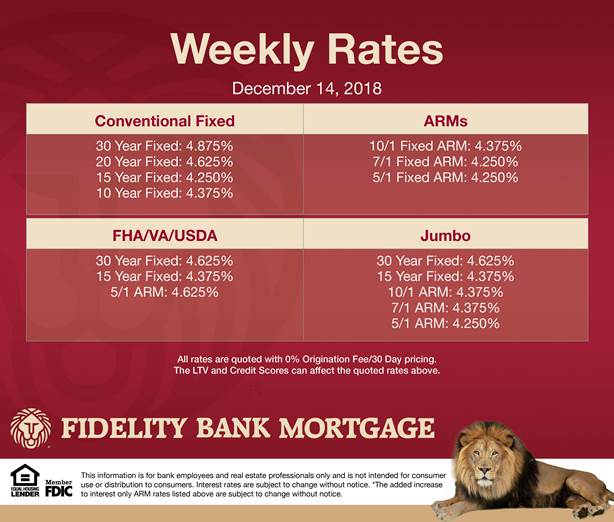

0 Points

Recent Comments