Significant Life Events

What is the number one reason people move? Life’s milestones often serve as motivation for housing decisions. Whether it’s tying the knot, starting a family or pursuing career advancements, these pivotal moments ignite aspirations for stability and growth. These milestones contribute to a sustained and, at times, pent-up demand for a move.

Declining Mortgage Rates

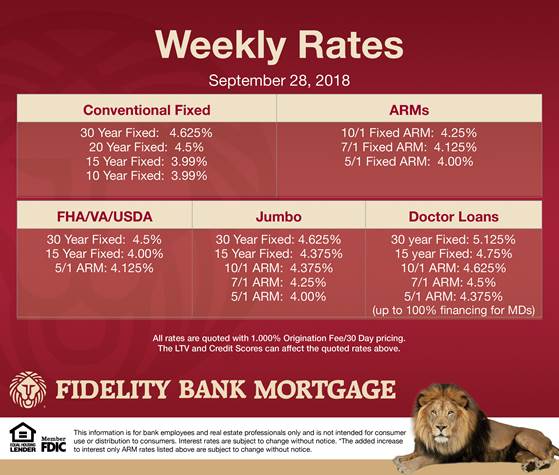

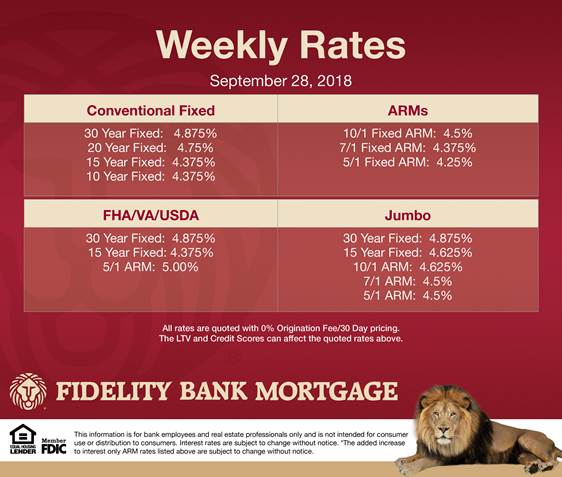

Against the backdrop of life’s milestones, the changing mortgage rates have a considerable influence on housing demand. Declining mortgage rates, in particular, are a powerful stimulant, giving prospective buyers increased purchasing power and motivating them to enter the market...

Read More

Recent Comments